CMI Media Statement

Statement attributable to John Connor CEO, Carbon Market Institute.

As world leaders depart COP26, the aftermath of the glitz and drama is in. Progress, while still insufficient, is not as gloomy as some are painting it to be and there have been highly significant investment steps overnight.

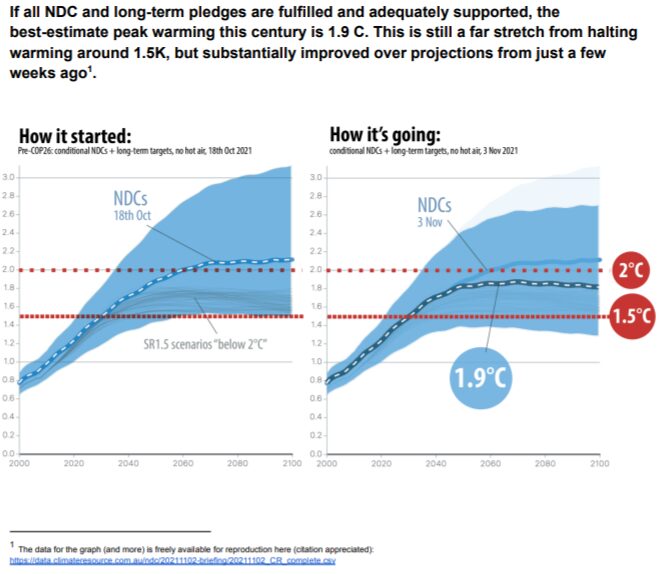

A Briefing Paper from NDC tracking NGO Climate Resource graphically summarising new pledges and commitments concludes:

There is no time for complacency, and the analysis stresses the needs for extra policies this decade. Progress over the next ten days on supporting rules on carbon markets is also important. However, the Paris Agreement “ratchet” process, that builds in political moments of pressure, accountability and reinforcement of economic and moral responsibility*, is making progress.

The headlights are pointing in the right direction, but whether we have the private and public policy engines to get there remains a work in progress.

With leaders gone, negotiators are now working on the painstaking details. Good progress and flexibility was reported in Article 6 carbon market rule negotiations. Overnight, focus was on Article 6.2, “international transfer of mitigation outcomes” – or the inter country trade of carbon credits – and technical discussions of how and when corresponding adjustments in national inventories occur.

International carbon market rules matter, as analysis from the International Emission Trading Association shows resulting international cooperation could result in savings of $250 billion per year, and this could lead to a further 50% emissions reductions.

Earlier this week, I noted that attention shouldn’t just be on the COP26 negotiating channel, as other channels of progress were running deep. We saw examples regarding this on Day 2 with global deforestation and methane pledges. Overnight substantial announcements were made in the world of finance. These included the launch of the Glasgow Financial Alliance for Net Zero, pledging that climate will be central to the investment of their collective US$130 trillion ($AUS175 trillion). This is more than the estimated $100 trillion required to finance the transition over the next three decades.

Other important developments included the announcement that the IFRS Foundation, the international accounting standard body, will establish a new International Sustainability Standards Board to develop globally consistent climate and broader sustainability disclosure standards for the financial markets. This will be another important channel of climate related accountability and action.

Today, Australia’s financial regulators have also announced further ways they will be aligning financial management with climate risks.

Finally, it is also important to highlight initiatives underway for “de-browning” not just greening investments. A historic $8.5 bn funding agreement was announced yesterday between South Africa and the US, EU, UK, Italy and Germany to assist the early phase out and replacement of their coal power fleet. Closer to home, overnight the Asian Development Bank has launched a plan that aims to help Indonesia and the Philippines retire 50% of their coal fleet over the next 10 to 15 years. And in a highly significant step, 190 countries and organisations have agreed to rapidly phase out coal power, signing on to a Global Gola to Clean Power Transition Statement. Australia is missing from the list.

There is much work to be done over the next ten days and ten years but day 3 of COP26 has brought cautious optimism.

*For a brilliant piece on the positive psychological process at play with Paris Agreement COPs, I recommend this piece from Politico EU. It is a reminder that the Paris Agreement, with its “bottom up” nationally determined contribution and regular “ratchet” political moments of transparency, is a grinding normative not decisive punitive framework.

For further commentary and analysis please view the CMI’s COP26 hub which includes a further analysis today of all of week one to date.

The Carbon Market Institute is the independent industry association for business leading the transition to net zero emissions. Its over 120 members include primary producers, carbon project developers, Indigenous corporations, legal and advisory services, insurers, banks and emission intensive industries developing decarbonisation and offset strategies.

To interview John Connor please contact Clare Price on 0490 252 743 or email clare.price@carbonmarketinstitute.org