As a veteran of excessive build up at the “Hypenhagen” 2009 COP, claims that Glasgow is the “last and best chance” has a familiar feel to it. Countries need to be judged by their contributions and compromise over coming days. However, as the UK High Commissioner told our COP26 Carbon Conversation last Friday “climate diplomacy doesn’t end with the COP26 communique”. The same goes for climate-linked investments. The reality is that 2015 Paris Agreement spawned forces in global capital markets and boardrooms unstoppable if as yet insufficient in scale, UNFCCC COPs are not the only channel to watch.

When it comes to carbon markets, proper coordination of corporate and national efforts through shared, agreed international rules-based arrangements like Article 6 of the Paris Agreement is the optimal. We should be striving to build on the emerging architecture already seeing bilateral deals such as that by Switzerland and Peru and estimates that proper Article 6 rules could boost emission reductions by 50% at least. However, it would be foolish to ignore other rapidly emerging channels such as carbon border tariffs, higher capital costs for carbon intensive industries, voluntary carbon markets, EU climate taxonomy, and sectoral trade arrangements such as that announced overnight by EU and US for steel and aluminium.

While finalising Article 6 rules is a carryover of unfinished business from 2018 and 2019 COPs, this COP was designed to be an ambition COP focusing on boosting both mid-century long-term goals and 2030 Nationally Determined Contributions. You could argue COP26 has already been a partial success on these fronts. There has been a stream of announcements this year with the Paris Agreement and related processes reducing potential global warming. However, the reality is we remain on track to blow past the crucial 1.5C threshold without substantial increases in ambition and action this decade.

While we welcomed the net-zero 2050 target and initiatives like the Indo-Pacific Carbon Offsetting Scheme, Australia’s long-term strategy was a litany of missed opportunities. The growing chorus of business representatives and industry groups pointing to the Safeguard Mechanism as a potential market tool to drive decarbonisation and drawdown/sequestration investments were as frustrated as CMI by it being overlooked.

The strategy’s use of offsetting and modelling behind it requires clarification in addition to inadequate 2030 goals and policies. While CMI members, and research from others like the Grattan Institute, say the scale of offsetting of up to 120Mt per year by 2050 is theoretically possible, it would be extremely challenging requiring a lot of elements to align. Trusting this to voluntary markets and modelled prices of around $25 per tonne in 2050 is a highly risky underpinning for a national strategy.

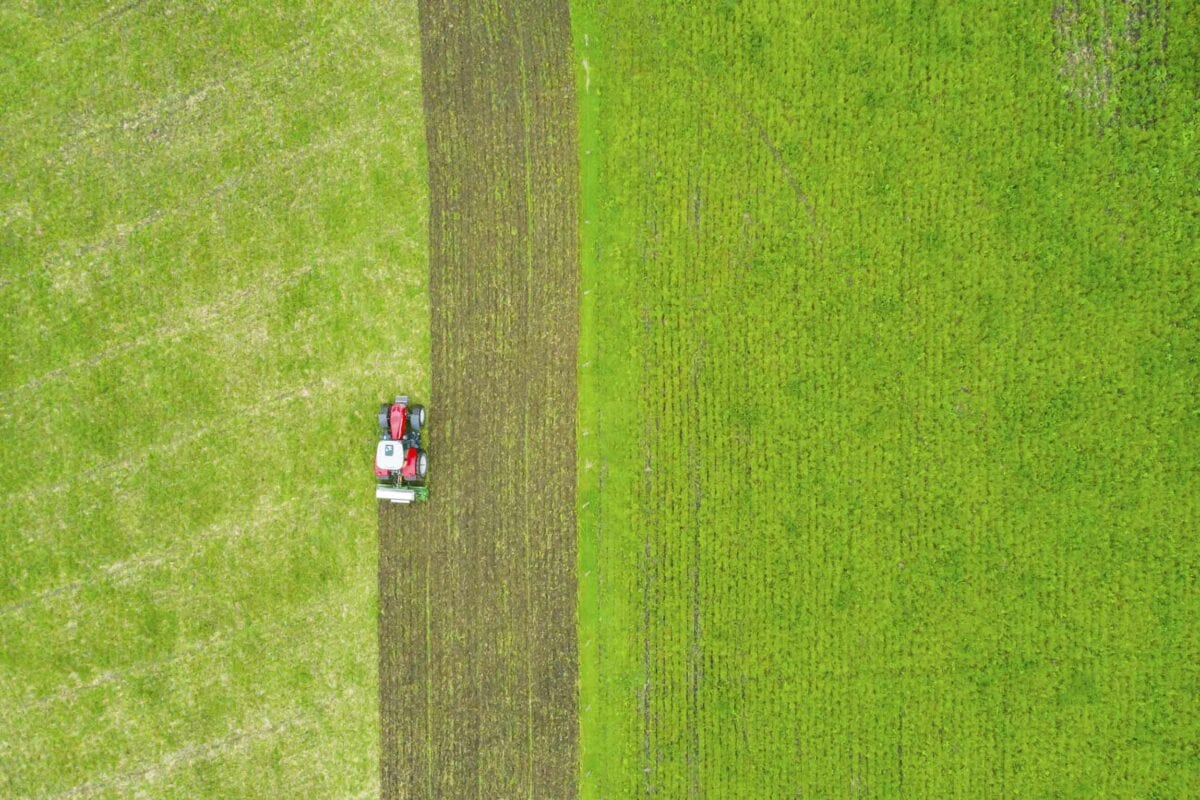

Arbitrary restrictions limiting land able to be used for carbon farming to a third of a property is as potentially devastating to this goal as it is astonishing. That the only mandate in “The Australian Way” is one limiting landholders and property investors is an extraordinary concept and difficult to see how it could be implemented. Carbon farming should and can be aligned to agricultural productivity and ecosystem resilience and there is little data behind the alleged problem that this solution is apparently trying to address. CMI is working with local, state and national governments to establish harder data and this, as well as the Government process for developing its own “priority” integrated farming ERF/ACCU methods, are among more appropriate channels to address this.

As this update shows, and the next two weeks will reveal, there is much going on – on many levels. To help, CMI has created a special website, will conduct two further special COP26 Carbon Conversations, and will provide member memo updates over the next two weeks. We’ll also summarise key takeaways in a briefing paper after the COP and most importantly explore the outcomes at our Summit in Sydney on 9 and 10 December. Excitingly, this will be both on-line and in person with many of you able to attend and we look forward to seeing you there!

Regards,

John Connor

CEO

Carbon Market Institute