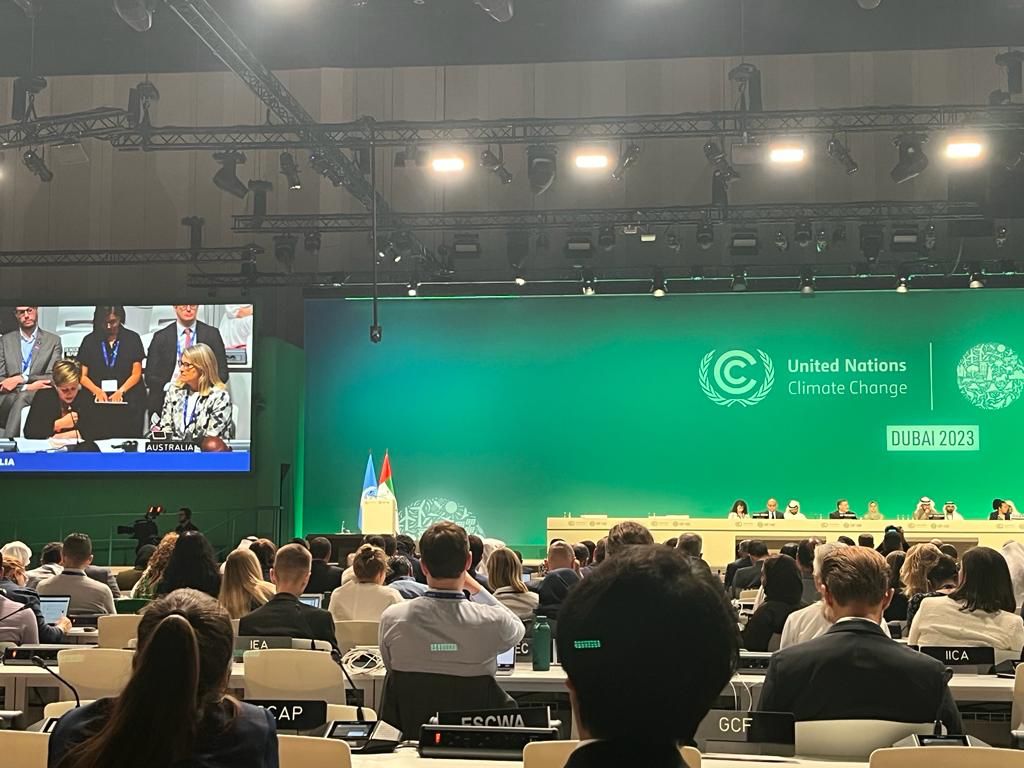

At a pivotal half-way point of COP28, the Carbon Market Institute’s (CMI) COP Symposium event has heard from a range of experts on the state of negotiations so far, providing updates live from Dubai, as well as implications back home for Australian business and investment.

Hosted by partners the Commonwealth Bank, the event explored the key items at stake at COP28, including the global stocktake, Article 6 and global cooperation on carbon markets, indigenous engagement, corporate transition and implications for business & investment.

Key quotes

Mark Kenber, Executive Director, Voluntary Carbon Market Integrity Initiative

“There are a huge number of corporates increasingly committed to being on the front foot with emissions. It is now not only inevitable, but desirable.”

“There has been a noticeable shift in mindset away from pure compliance – businesses are now asking how they can use measurement requirements to drive performance.”

Zoe Whitton, Managing Director, Pollination

“We’re at an interesting moment in time where there is somewhat of mismatch of ambition. The structural economic environment is still not moving as fast as the transition for many businesses.”

Emily Gerrard, Director, Comhar Group

“Article 6 of the Paris Agreement is about helping countries achieve NDCs. What will make it attractive, or unattractive, will be closely tied to how simple it is to navigate. We need to avoid adding further complexity where we can.”

Janet Hallows, Director, Climate Programs & Nature-Based Climate Solutions, Carbon Market Institute

“In relation to Article 6, it’s clear that different countries have different levels of readiness when it comes to supporting these market mechanisms. From governance and institutional arrangements to legal frameworks, infrastructure, and social licence safeguards, it’s a big piece of work and we should be actively supporting host countries to get up to speed.”

Clark Donovan, Associate Director of Indigenous Carbon, Commonwealth Bank

“We need to approach all interactions with communities with a cultural lens. This means not rushing them, respecting their wishes and making sure they have as much information as possible.”

Alex Matthews, General Manager, Climate Strategy & Commitments, Commonwealth Bank

“In some parts of the economy, the technological pathways [in the transition to net zero] are less clear and making business decisions in the context of that uncertainty is very challenging. The role the finance sector must play here is to help companies to manage this risk.”

Kurt Winter, Director, Corporate Transition, Carbon Market Institute

“The first week saw the alignment of six major independent voluntary carbon crediting standards and the establishment of an end-to-end integrity framework bringing together key international organisations. This alignment is a significant shift and will be critical in building demand from corporates.”

Further reading:

CMI’s COP28 halfway progress report

CMI’s COP28 Priorities & Calls to Action paper

CMI CEO John Connor is available for comment. John is the former Executive Director of the Fijian Government COP23 Presidency Secretariat. For further information, please contact Thomas Hann: thomas.hann@carbonmarketinstitute.org.au.

About the Carbon Market Institute

The Carbon Market Institute (CMI) is a member-based institute accelerating the transition towards a negative emissions, nature positive world. It champions best practice in carbon markets and climate policy, and its 150+ members include primary producers, carbon project developers, Indigenous organisations, legal, technology and advisory services, insurers, banks, investors, corporate entities and emission intensive industries. The positions put forward constitute CMI’s independent view and do not purport to represent any CMI individual, member company, or industry sector.