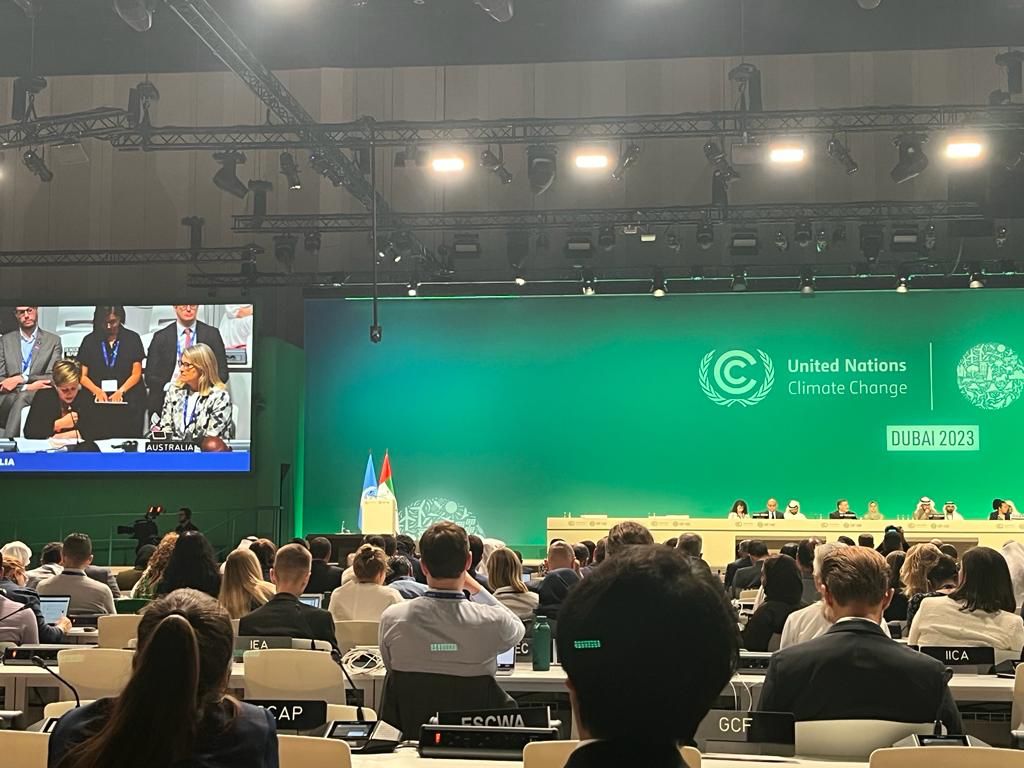

As negotiators and delegates take a well-earned rest day after the first week at COP28, discussions are finely balanced across key fronts. However, the incoming swathe of political leaders have numerous challenges to resolve in week two, according to the Carbon Market Institute (CMI).

Strong early momentum hasn’t translated to ideal progress in the formal negotiations. There’s much to do to land adequate guidance from the historic global stocktake and sufficient progress for carbon markets and adaptation.

CMI welcomed a number of key developments so far, including:

- The launch of the long-awaited G7-endorsed Climate Club, aims “to make decarbonised industrial production the default business case.” Australia is one of 36 founding members.

- The launch of an Industrial Transition Accelerator to speed decarbonisation across heavy-emitting sectors, including energy, industry, and transportation.

- Australian-backed pledges to triple the rate of renewables deployment and double the rate of increase in energy productivity.

- Australia joined the Clean Energy Transition Partnership, committing to end direct international public finance for fossil fuel projects – a significant redirection of international aid and diplomatic focus.

- Australian-backed commitments to recast aspects of international financial architecture to better assist developing and climate change-vulnerable countries.

- A series of historic initiatives in the Voluntary Carbon Market (VCM), including the alignment of six major independent voluntary standards and the establishment of an end-to-end integrity framework bringing together key international organisations. A Full summary of key VCM outcomes is available here.

“As ministers arrive at COP for a crucial second week of negotiations, there is a lot at stake to avoid paralysis on key items, namely the all-important text for the global stocktake process. Without clear guidance from this, we risk squandering the last chance for a course correction to limit temperature rise to 1.5 degrees,” said John Connor, CMI CEO.

“For Australia’s part, it is an opportunity to further step up its commitment on the global stage, including clarifying its support for funding mechanisms such as the Green Climate Fund and the Loss and Damage Fund, as well as its intentions with key initiatives such as the Morrison government’s Indo-Pacific Carbon Offsets Scheme, to invest in collaboration with the Pacific.”

Outlined below are a number of items still to be resolved in week two on CMI’s key priorities. For a more detailed overview of CMI’s key asks from both an international and domestic point of view, access our COP28 Priorities & Calls to Action paper here.

Progress against key priorities

Global Stocktake Course Correction Roadmap

“This COP is the first of five yearly global stocktakes in the Paris Agreement ratchet mechanism. Clear collective decisions here are important guidance for countries as they develop their next targets for 2035 due in early 2025. While there is a growing majority supporting the tripling of renewable energy and doubling of energy productivity, there are differences in positions on fossil fuel phase out.”

A clear path towards Article 6 carbon market operationalisation and readiness

“COP28 has seen greater support from political and business leaders on the importance of carbon markets as a key source of climate finance and there has been strong progress in integrity initiatives in voluntary markets. However, there are resolvable differences of approach on transparency, methodologies and carbon removals that Ministers will need to address.”

High integrity approaches to corporate and industrial net zero transition

“Welcome progress on climate collaborations between countries and industry can lead to final decisions being made, including platforms and priority for high integrity in corporate reporting and participation in UNFCCC processes.”

Scaling up and acceleration of climate finance, including the operationalisation of the Loss & Damage Fund

“This COP is an important stepping stone needing to provide guidance to new climate finance goals scheduled to be agreed at next year’s COP. There are some differences on the sources and nature of finance between developed and developing countries at this COP, but the outcome needs to help achieve goals that are ambitious, accountable and inclusive of private as well as public finance.”

Adaptation, nature-based solutions and just transition work program decision

“The historic early progress in agreeing the Loss and Damage Fund and funding arrangements and contributions to the Green Climate Fund has overshadowed commitments to adaptation funds and the global goal on adaptation, which are supposed to be in focus at COP28. Progress on adaptation commitments will be vital to developing countries support for a final package and there appears to be momentum on integration of nature-based solutions and just transition text into final decisions.”

CMI CEO John Connor is available for comment. John is the former Executive Director of the Fijian Government COP23 Presidency Secretariat. For further information, please contact Thomas Hann: thomas.hann@carbonmarketinstitute.org.au.

About the Carbon Market Institute

The Carbon Market Institute (CMI) is a member-based institute accelerating the transition towards a negative emissions, nature positive world. It champions best practice in carbon markets and climate policy, and its 150+ members include primary producers, carbon project developers, Indigenous organisations, legal, technology and advisory services, insurers, banks, investors, corporate entities and emission intensive industries. The positions put forward constitute CMI’s independent view and do not purport to represent any CMI individual, member company, or industry sector.