-

Date

13 - 14 Aug 2025

-

Location

CENTREPIECE, Melbourne

CMI International Carbon Market Roundtable

2025 Australasian Emissions Reduction (AER) Summit

Date

13 - 14 Aug 2025

Location

CENTREPIECE, Melbourne

Nations have a new September deadline for 2035 emission reduction commitments amidst tumultuous geopolitics. There is also fresh scrutiny on the social, technological and commercial ability to achieve net zero emissions with sufficient urgency to meet the Paris Agreement global warming goals. There are plenty of opportunities as well as challenges. With a fresh focus on innovation and market investments this Summit will explore net zero national and sectoral plans as well as corporate commitments as countries and companies work towards carbon and nature goals.

AER Innovation Hub

New for 2025, the Carbon Market Institute is excited to introduce the Innovation Hub—a bold, immersive experience, designed to break the mold of traditional content delivery.

The Innovation Hub offers an agile space for real-time idea exchange, critical debate, and emerging solutions. Three themed Pavilions will run simultaneously across the Hub, each with dedicated seating, creating dynamic environments for open panel sessions, peer-led discussions, and sponsor-curated content.

The Three Innovation Pavilions

Please access the program tabs for more information on topics and speakers.

Tuesday 12 August 2025

CMI International Carbon Market Roundtable

Seminar - Translating transition plans into industry imperatives

Hosted by Aurecon with Lunch on Arrival

This pre-summit seminar illuminates how organisational transition planning becomes a roadmap for action on net zero and decarbonisation.

The shift from planning to action is underscored by a range of Australian policy frameworks and international best practice guidance that continue to evolve and mature on matters including certification of progress against targets and the role of carbon markets.

The seminar will draw presenters from industry, advisory and academia to offer insights on:

The session will be of interest to sustainability, strategy, finance and decarbonisation practitioners across industry, as well as service providers and advisers looking to drive effective transition planning approaches for organisations.

The seminar includes lunch on arrival and will close with an hour of networking drinks.

Transition planning as a basis for action by industry

Kurt Winter

Charlie Turner

The state of industrial decarbonisation in Australia – Unlocking opportunities

Industrial decarbonisation presents unique opportunities and challenges in in Australia. This presentation will contemplate the size of the prize as well as technology and economic considerations. Barriers and drivers for industrial decarbonisation will also be explored, having regard to sectoral differences.

Dr. Ben McGarry

How the market can shape action by industry

This segment will look at the pricing signals to industry, being driven by ACCU pricing and the reformed Safeguard Mechanism. Forward pricing, ACCU and SMC purchase and surrender and the impact of uncertainty will also be examined.

Georgia Cox

Investment decision making in industrial decarbonisation

Investment decision making can be complex, requiring careful consideration of strategic, compliance and commercial pressures. This segment will delve into investment strategies and how to build a successful business case for industrial decarbonisation projects and initiatives. Topics discussed will include capital allocation, hurdle rates, use of ACCU pricing, project timing and inclusion of co-benefits.

Dr. Taira Vora

Q&A panel

Moderator

Kelly Smith

Break

Building organisations for transition planning

Drawing on the experience of a major Australian corporation, insights will be provided on the organisational efforts required to create a transition plan. Topics for discussion will include resource allocation, cross-functional contributions and embedding the transition plan into organisational systems and processes.

Dr. Gates Moss

Developing competencies and skills

Successfully creating and actioning a climate transition plan requires input from a broad range of disciplines and skillsets. Insights will be provided on identifying and understanding the competencies required, enabling the creation of a strategic transition plan that drives action. It will also guide practitioners in identifying competency gaps and development opportunities to continue to lead in sustainability practice.

Dr. Franziska Curran

Q&A panel

Post Seminar Networking Drinks

Networking event for seminar attendees.

Networking event for event sponsors & special guests. Invitation only.

Wednesday 13 August 2025

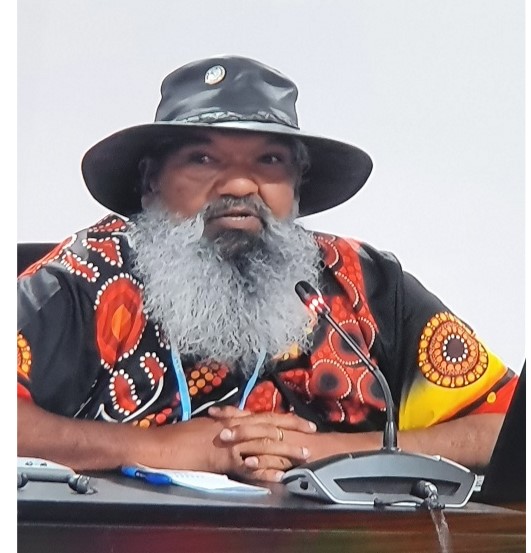

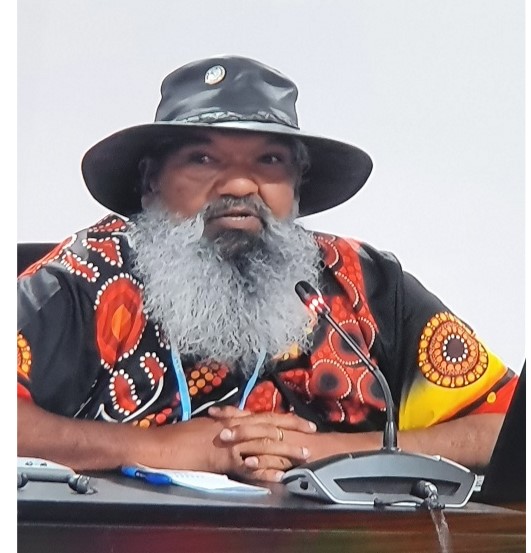

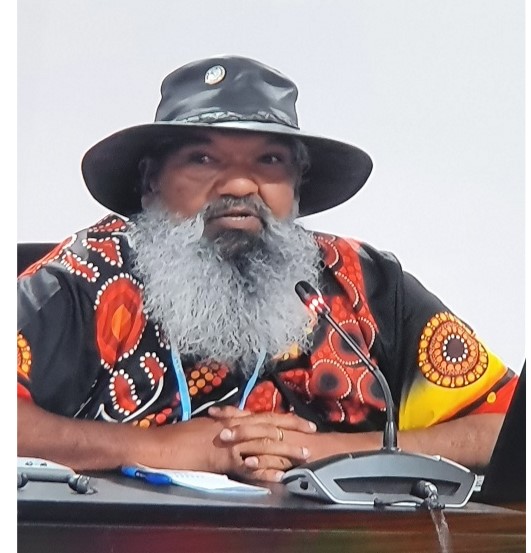

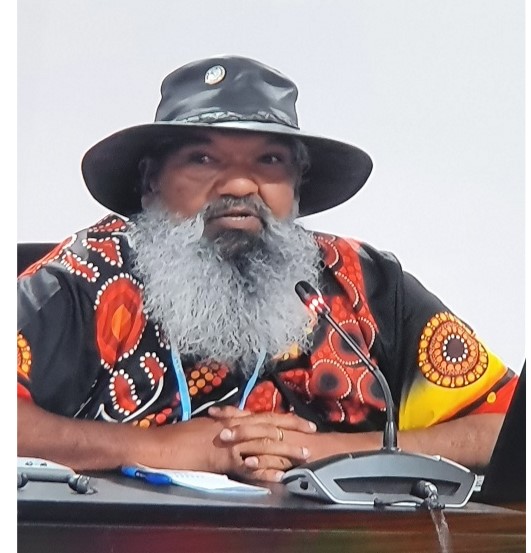

Welcome to Country - Wurundjeri Woi Wurrung, with performance by Ganga Giri

2025 AER Summit Opening Address

Next Steps for Net Zero

Kurt Winter

Ministerial Keynote

Hon. Lily D’Ambrosio

Plenary One: The Net Zero and NDC challenge is now

As the September deadline for 2035 Nationally Determined Contributions (NDCs) looms ahead of Brazil’s November COP30, and the window for keeping global heating to 1.5C narrows, bipartisan Net Zero by 2050 targets and business support are under threat. This session will set the scene for the Summit with an examination of international and market movements, scientific realities and the targets countries and companies can and should be heading for.

Moderator

Mara Bún – Brazil/COP30

Chris Halliwell – Markets & Investment

Matt Kean – Accelerating momentum

Elder Leslie Schultz – First Nations

Melita Keywood – Science

Plenary Two: Challenges in the corporate transition

Despite 2024 being the hottest year on record, there are questions whether corporate climate action is cooling. Join corporate leaders to discuss challenges in the corporate transition to net zero emissions. Can they juggle shareholder, community and investor pressures? Are they drowning under disclosure requirements? What are key lessons from the last decade of sustainability and transition planning? Is the capital there for the 1.5C transition? How are CEOs managing the personal and organisational obligations?

Moderator

Dr. Kerry Schott AO

Sanjeev Gandhi

Geraldine Slattery

Frederick Teo

1.1 Markets: How can strong carbon pricing and investment signals facilitate an ambitious 2035 NDC?

With the ALP entering its second term in government with a super majority, there is renewed discussion about revenue-generating carbon pricing reforms. What might this look like in Australia and how can we maximise current carbon pricing and investment signals in Safeguard and complementary policies at national and state levels? How can an articulated government carbon market strategy assist in coordinating and enhancing existing and future carbon price signals?

Moderator

Kurt Winter

Carl Binning

Emma Herd

Frank Jotzo

Georgia Cox

1.2 Investment: Investing in tomorrow: A national carbon market strategy to scale long-term carbon removals

Both novel (durable) and conventional (nature-based) carbon dioxide removal (CDR) will be needed to counterbalance residual emissions and correct temperature overshoot as we approach our net zero target years. In Australia, the Climate Change Authority recommends a national carbon market strategy to guide net zero planning, and the government is factoring the strategic role of markets into its sectoral decarbonisation plans. Among other things, a carbon market strategy could guide long-term investment to scale removals in a way that does not delay or replace immediate action to reduce emissions—including informing how the ACCU Scheme may be leveraged to scale CDR. This workshop will bring together CDR technology experts, policy specialists and investors to discuss how carbon markets can be harnessed to scale vital CDR technologies while avoiding decarbonisation delay or other perverse outcomes, and which other markets or financial tools are needed.

Moderator

Gabriella Warden

Daniel Ota

Danielle de la Cour

Henry Adams

Gavin Mongan

1.3 Corporate Strategy: Scope 3: Too hot to handle?

Addressing scope 3 or ‘value chain’ emissions is one of the most complex and critical challenges facing corporates in the net zero transition. This workshop brings together expert advisors, business leaders, and practitioners to unpack the key hurdles and emerging solutions for tracing, measuring, and reducing emissions across the value chain. From supplier engagement to consumer behaviour, we’ll explore strategies for collaboration and data transparency. The session will also delve into the emerging concept of beyond value chain mitigation—including how it can play a vital role in bridging gaps where emissions data or influence is limited.

Moderator

Philip Link

Meredith Read

Tara Oakley

Ary Cordero

Pete Wangwongwiroj

Nature-based Solutions. Unlocking investment in co-benefits

Showcasing platforms and frameworks to robustly quantify, report and value co-benefit. Learn about outcomes. to appropriately account for and invest in the carbon and co-benefits of nature-based solutions and understand the evolving markets that support them.

Moderator

Janet Hallows

Dr. Kate Dodds

Dr. Amanda Hansson

Ash Knop

Brett Giddings

Minal Deshkar

Industrial. Innovations in Net Zero emissions transport

Transport is Australia’s third largest emitting sector, contributing more than a fifth of national emissions. While we await the Australian Government’s sectoral decarbonisation plan to provide a flightpath to bending transport emissions down, leading transport providers are already accelerating ahead with solutions for low emissions transport. Join us after lunch at the Industrial Pavilion as three companies at the forefront of innovation in aviation, rail and road give us a glimpse into the future and showcase net zero transport technologies they are driving forward.

Moderator

Dr. Gates Moss

Helen Rowe

Chau Le

Communities. Opportunities for Indigenous Leadership: Carbon and Nature

Indigenous leaders will showcase their deep connections to land, sea and water – addressing how Indigenous-led initiatives and projects are crucial to achieving a net-zero economy. The road to net zero is forged through First Nations lands and communities. Full and autonomous participation is essential for a just and equitable transition. How do we ensure and foster this, alongside economic self-determination, access to finance as well as benefit-sharing in the new green economy?

Moderator

Alexander Burns

Brian Warner

Matthew Burns

Plenary Three: Can we sustain public and private capital for Net Zero?

Are decarbonisation and net zero policies up to the task of coordinating the multitude of national and state funding initiatives? Are they crowding in or crowding out the necessary private capital? Can they deliver tangible and inclusive results to sustain long term investor and community confidence? How can the Net Zero Plan and six sectoral plans support this and harness carbon markets and market mechanisms to incentivise emissions reduction across the economy? Can these investments be sustained in the face of rising adaptation challenges and the need to ensure affected workers and communities are not left behind? This panel will discuss how public funds and policy best accelerates private investments, productivity and prosperity.

Moderator

Yu Zhang

Rebecca Mikula-Wright

David Shankey

Ian Learmonth

Meg McDonald

Nature-based Solutions: Showcasing advanced land data technologies

Satellite and other remote sensing and imagery technologies are evolving at a rapid pace, and yet their integration into publicly available national datasets continues to lag. This pavilion session will showcase some key technologies being used by the carbon industry to robustly monitor and verify ACCU Scheme project outcomes.

Moderator

Zoe Ryan

Peter Moulton

Dr. Tim Moore

Industrial: Innovations in Net Zero emissions industrial energy

The Australian industrial sector is energy intensive and high emitting, and emissions can be difficult to reduce. Despite this, decarbonisation is essential to support Australia’s prosperity in a net zero emissions world. Stop by the Industrial Pavilion following afternoon tea and meet these companies who are rising to the challenge and pioneering energy solutions.

Moderator

Thomas Hodgson

Pauline Kennedy

Katie Brown

Communities: Innovations in Australian and international just transition

Since the turn of the 20th century, Australia’s wealth and prosperity has hinged on the regions. Mining and fossil fuel extraction has powered Australia’s energy security and economic success—and continues to drive development across much of the world. With the global economy now phasing down fossil fuels, how can we best support a swift but equitable transition for those regions and countries most notably affected? Join just transition policy experts and thought leaders at the Communities & First Nations Pavilion to learn about the innovative approaches governments and communities are taking to ensure those regions and countries at the coalface of transition can not only overcome challenges but thrive as they power us towards net zero emissions.

Moderator

John Connor

Alison Tate

Rachel Livingston

Georgina Woods

Plenary Four: Are corporate regulations and transition planning expectations sufficient to green business practice?

Corporate practice is under intensifying scrutiny from regulators, investors and the community. The last 12 months have seen significant developments in governance and competition policy with productivity improvements now in focus. The introduction of mandatory climate change reporting will also re-write expectations for company management of climate-related financial risks and opportunities. How do we ensure that regulation and disclosure deliver more than just more reporting, genuinely informs public debate rather than delivering more data, and drives effective and efficient change?

This session includes a Provocation on Driving Productivity in Net Zero Transformation at the beginning of the plenary.

Moderator

Kurt Winter

Provocation

Barry Sterland

Sarah Barker

Sarah Sheppard

David Parker AM

Climate Hotspot

Perumal Arumugam

Women in Climate Function

Featuring Christiana Figueres Oration, Fireside Chat and Brazilian Dance

Women and girls make up half the world’s population, yet remain underrepresented in climate action and decision-making. Climate change impacts everyone, and solutions require everyone.

At the AER Summit, we highlight inspiring female leaders driving climate policy, showcasing their critical contributions and amplifying their voices in this essential work.

Each year, a distinguished climate leader delivers the Christiana Figueres Oration, a session named in honor of the first person who delivered this address in 2014. This year we are delighted to welcome economist, professor and diplomat Laurence Tubiana. This year, the Oration will be pre-recorded.

Additionally, this year we are excited to be joined by two incredible women, Dr. Francine Tavares and Mara Bún, for a fireside chat where they will discuss their career journey to date, how the landscape has changed for women participating in climate change in the past 10 years, and how we can support greater gender parity in climate-change decision making moving forward.

5:45-6:00pm

Laurence Tubiana – Christiana Figueres Oration

6:15-6:45pm

Mara Bún – Fireside Chat

Dr. Francine Tavares – Fireside Chat

President Ramos Horta will speak to the Summit theme of Next Steps for Net Zero, to regional expectations for Australian leadership in the coming NDC, and to the importance of investment in climate solutions in Timor Leste and the broader region.

H.E. Dr. José Ramos-Horta

Thursday 14 August 2025

Day 2 Opening Address

Dr. Kerry Schott AO

Climate Hotspot and Q&A

Gina Cass-Gottlieb

Plenary Five: How central are markets to restoring and protecting nature?

Australia has committed to halt and reverse biodiversity loss by 2030, aiming to be nature-positive by 2050, alongside its carbon goals. Carbon and nature repair markets can incentivise action, value ecosystem services and redirect investment but what is their contribution to achieving these global goals? How is the necessary public and private investment to be harnessed as environmental approval laws dating to the last century are overhauled? What is needed to sustain the necessary social licence and benefit sharing with regional, including Indigenous communities? What international lessons are there for us, or for us to share?

Moderator

Skye Glenday

Dr. Jody Gunn

Katharine Tapley

Laura Higgins

Elder Leslie Schultz

Prof. David Karoly

Keynote

Hon. Dan Tehan MP

Plenary Six: Climate Q&A - How can Australia's 48th Parliament deliver climate ambition and equitable net zero transition?

In the style of the ABC’s former weekly discussion program, Australian political, business and community leaders will discuss strengthening national climate ambition in the 48th Australian Parliament. As the Coalition rebuilds following Labor’s landslide election victory and with Australia’s COP31 bid still live, what should the Australian Government’s policy priorities for decarbonisation be? Is it possible to advance an inclusive agenda that meets the needs and aspirations of Australians amidst cost-of-living pressures, spiralling climate impacts and a fragmented media? And can we go further in this term of government to not just preserve the bipartisan Net Zero 2050 target, but build consensus to strengthen national ambition?

Moderator

Lenore Taylor

Dr. Monique Ryan MP

Anna Skarbek

Kurt Winter

Elder Leslie Schultz

2.1 Markets. Accelerating ACCU Scheme reforms for Safeguard delivery and NDC ambition

ACCUs are a key tool for Safeguard Mechanism compliance as well as investment across economic sectors. The ACCU Scheme review reform recommendations should accelerate or become a handbrake to climate ambition. What are the priorities and milestones ahead and what have been the key challenges for government, regulators and business? This panel will review progress in implementing the 2023 recommendations of the Independent ACCU Review led by Professor Chubb.

Moderator

Janet Hallows

Samuel Dawes

Marc Train

Kath Rowley

2.2 Investment. Industrial Carbon Capture: Fig leaf or the future?

Carbon capture and storage (CCS) and carbon capture, utilisation and storage (CCUS) are critical technologies for mitigating climate change and play a significant role in IPCC emissions reduction scenarios. Pioneering projects demonstrate mixed results and there are technical and financial barriers to scaling the industry. Questions also remain on how CCS and CCUS technologies can be best used in the transition. This panel will examine recent CCS and CCUS technology and policy developments and explore investment and on-ground realities.

Moderator

Damian Dwyer

Ian Havercroft

Kevin Morrison

2.3 Corporate Strategy. Green claims, grey areas: Where to next for voluntary climate action?

As international best practice standards and guidance on corporate net zero transition continue to evolve and mature, businesses are under increasingly pressure to demonstrate credibility in their corporate transition plans and the claims and actions that underpin them. Why should corporates consider voluntary climate action to support net zero transition planning? Are standards and programs on voluntary action mature enough now to help corporates confidently navigate greenwashing risks?

Moderator

Evan Stamatiou

Luis Filardi

Michaela Morris

Elizabeth Holzer

Ministerial Keynote

Hon. Chris Bowen MP

Nature-Based Solutions: The green economy: Harnessing the value of forests

Plantation forestry across Australia has an integral role to play in supporting Australia’s emissions reduction targets, while also providing economic opportunities through the supply of domestic timber products. While plantation forests currently sequester around 11.5 Mt CO2-e per year, the CSIRO estimates that this industry could be sequestering upwards of 630 Mt CO2-e per year. This session will explore the opportunities and trade offs associated with scaling up plantation forestry, including how biodiversity outcomes and agricultural production can co-exist with the timber industry as we shift towards a green economy.

Moderator

Samuel Dawes

Carly Hammond

Alice Herbon

John Lawson

Industrial: Methane Busters: Innovations in measurement and abatement

Its potent global warming potential means that addressing methane is critical to limiting near-term temperature rise. While there are technologies for capturing and destroying methane, measurement can be challenging—which makes incentivising methane abatement difficult. The Australian Government has convened an Expert Panel to explore top-down methods for measurement and reporting of fugitive emissions, while innovations in abatement are emerging for waste and agriculture. Our presenters showcase innovations in measuring and reducing methane emissions as well as emerging innovation in methane abatement.

Moderator

Gabriella Warden

Scott Barker

Tom Breen

Jarrod Irving

Meagan Wheeler

Communities: Regional focus on the Pacific and Timor Leste

Pacific nations are looking to carbon markets as a crucial source of investment in assisting delivery of their NDC and sustainable development goals. Join this pavilion to learn from local Indigenous and regional community leaders about supporting carbon and nature markets for regional response to climate change.

Moderator

Dayana Flores

Brad Kerin

Leopoldina Guterres

Brian Warner

Plenary Seven: Is International co-operation drowning or waving?

It’s crunch time for international co-operation with rapid geopolitical shifts, economic transformation and climate impacts. This plenary will explore Australia’s evolving role and opportunities for emission reduction and resilience cooperation with Asia Pacific neighbour countries and other trading partners, including China and the US. There have been significant advances in Paris Agreement and global crediting mechanisms and consideration of carbon policies in trade, tariff and border adjustments. Expert panellists will explore whether international cooperation is dead as COP30 looms and the campaign for an Australian/Pacific COP31 advances.

Moderator

Emily Gerrard

Finau Soqo

James Shaw

Jacqui Ruesga

Takashi Hongo

Perumal Arumugam

3.1 Markets: Is it finally time for international carbon markets to shine?

With the Paris Agreement Crediting Mechanism now operational and methodologies being recognised, and the CORSIA compliance deadline fast approaching, global carbon markets are entering a new phase of implementation and maturity. But are voluntary and compliance markets on a competing course or are they converging? This session will unpack the latest trends shaping international carbon markets, assess the progress made, and examine what is needed to scale ambition, ensure integrity, and unlock meaningful benefits for host countries and the private sector alike.

Moderator

Mei Zi Tan

Stephanie Russo

Si Liang Puar

Alexander Lewis

Anil Bhatta

3.2 Investment: Powering Net Zero: Unlocking markets for grid and industrial energy transformation

Australia’s path to net zero for electricity and energy depends on transforming both the electricity grid and industrial energy solutions. As ageing coal generators retire and variable renewables ramp up, ensuring the grid remains reliable, efficient, and resilient is critical – an issue at the heart of the ongoing National Electricity Market (NEM) Review. This workshop will explore how market mechanisms and targeted investment can support the transition of Australia’s electricity market system.

Moderator

Anna Freeman

Tristan Edis

Richie Merzian

Wei Sue

3.3 Corporate Strategy: Boardroom Masterclass

This interactive mock boardroom masterclass will dramatise a critical board meeting at Iceberg Industries, a major resources company, as it navigates investor and regulatory scrutiny around climate risk management and transition planning. The scenario explores tensions arising from public commitments versus internal actions, highlighting governance challenges, investor concerns, and strategic decision-making required to ensure asset resilience against climate-related risks. Participants will discuss real-world complexities faced by directors, addressing tough shareholder questions and providing insights into effective climate governance and transparent communication.

Moderator

Peter Castellas

Elisa de Wit

Tim Buckley

Vicki Mullen

Closing Plenary: Urgent priorities for Net Zero momentum

This session will take stock of discussions from the Summit and highlight urgent priorities to ensure effective, inclusive and sustainable net zero-aligned 2035 corporate and country plans. Can we really align these with the investment needed for climate, nature and history repair? COP31 or not, how do we leverage Australia’s experience, skills and policy frameworks to drive ambition and investment in the Asia Pacific and include First Nations outcomes? Join our experts as they reflect on the domestic priorities and international cooperation that can accelerate decarbonisation and other climate and nature positive solutions, and the opportunities for both policy and investment.

Moderator

Anna Skarbek

Bret Harper

Baethan Mullen

Richie Merzian

Dr. Sally Box

About the Artwork

This year’s AER Summit lanyard artwork, created by Victorian-based Palawa artist Natalie Jade, represents connection, balance, and transition on the journey to net zero. The flowing lines and layered tones reflect the interdependence of people, nature, and systems – a reminder that achieving climate goals requires harmony between culture, community, and environment. Through this design, Natalie invites us to consider our collective responsibility to care for Country while shaping a sustainable future.

Learn more about the artwork here.