Experts and climate leaders from across the Asia Pacific are discussing opportunities and barriers to the development and increased sophistication of carbon markets in the region. The Carbon Market Institute has convened reginal climate leaders to Singapore for its 3rd Carbon Market & Investor Forum from 16-17 October 2025.

Over the two days, panellists discussed opportunities and issues around harmonisation of carbon markets, opportunities through Article 6 and CORSIA, and how transparency and integrity as essential ingredients to build trust and in turn grow the market. Topics also included the need for digital solutions for measurement, verification and validation to scale up solutions and methodologies.

CMI interim CEO and Director of Corporate Transition Kurt Winter opened day 2 by highlighting the opportunities for harmonisation across countries and markets in the region, underscoring the critical role of governments in building confidence in carbon markets to grow them.

“The development of compliance markets across the region contrasts the state of play just three years ago when CMI first convened this forum,” Winter reflected.

“Transparency, guidance and a greater focus on standardisation will help to build a more interconnected system across the region,” he concluded.

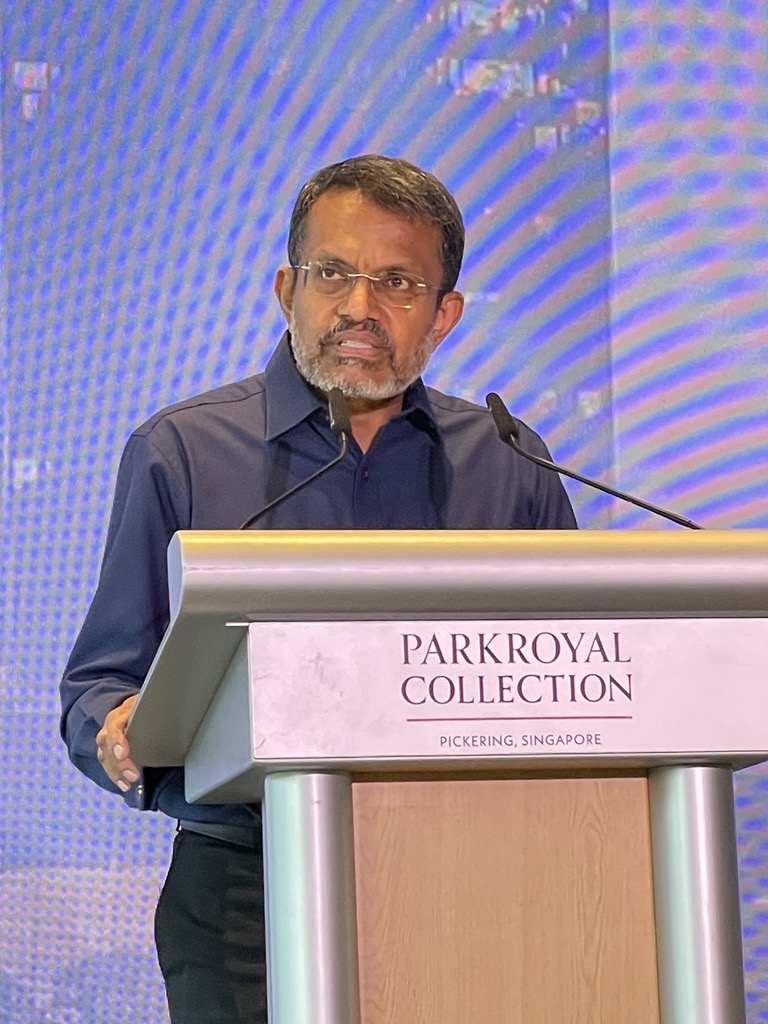

Benedict Chia, Director-General, National Climate Change Secretariat, Strategy Group, Prime Minister’s Office, Singapore, said that “Carbon Markets are really about organisations, countries, coming together to unlock […] opportunities that would not have occurred otherwise… It is essentially about channelling limited resources to places where the resources can go further so Carbon Markets allow us to do more at the same cost.”

CEO of ICVCM, Amy Merrill, presented in the opening keynote on day 2 and pointed out the need for alignment of climate and capital in the region:” We have incredible opportunity for action in this region that needs everyone’s mind engaged.”

“When we are talking about climate and capital, Singapore is such an exciting place to be, and the region is the place where all the action is happening. Singapore’s willingness to tackle the difficult stuff sets it apart.”

Merrill pointed out that the region will grow from currently 3.5% to 25% of the global energy consumption by 2030 as the fasted growing economies are located here.

She also spotlighted the opportunity for transition credits to bend the curve in the Asia-Pacific’s region’s energy transition, that remains a significant challenge in the region’s net zero journey given growing energy demand.

The opening plenary on Turning climate ambition into investable action on day 2 emphasised the need to speak the same language across the stakeholders and players in the carbon markets to create alignment between banks, financiers, projects developers, scientists, and governments and regulators.

Mischa Lentz, Head of Climate Finance & Principal Investment Specialist, Asian Development Bank, said: “The region has come a long way […] but 150m people in the region are still without access to electricity.”

Nikky Kemp, Executive Director, Singapore Green Finance Centre, sees one of the major hurdles to attracting finance as the “inability of global capital to understand nature.”

Andrew Chan, Partner, Asia-Pacific Sustainability Leader, PwC, sees a sophistication gap: “What are banks doing to help reduce the gap? There is a lot of work going on in upskilling and capacity building. Project developers need to bridge the gap to meet the banks requirement to attract finance.”

“We are speaking a different language of finance and carbon markets.”

Natalia Dorman, CEO & Co-Founder, Kita, identified time to get all stakeholders on board as the single biggest barrier to investable projects: “Projects take a very long time, at least 12 months as contract structuring is the hard part.”