Speakers at the Carbon Market Institute’s third Singapore Carbon Market & Investor Forum have highlighted the importance of carbon markets as an essential ingredient to achieve net zero across the region.

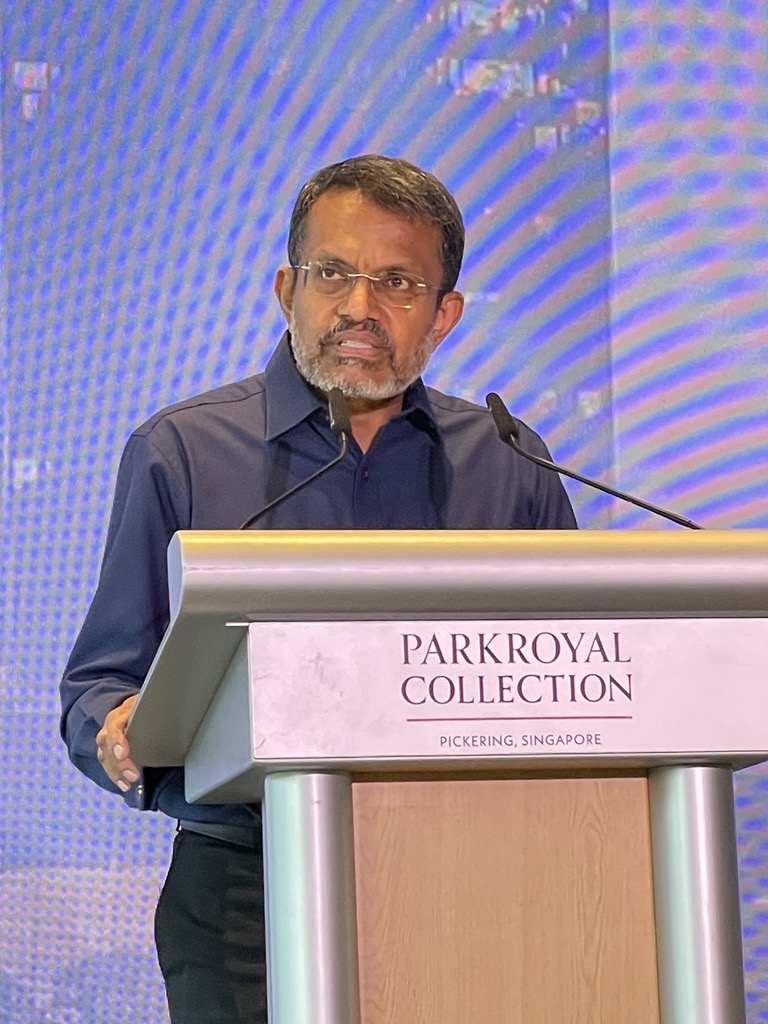

Singapore’s Ambassador for Climate Action, Ravi Menon said: “There is no pathway to net zero without carbon markets.”

The Ambassador also pointed out that: “The transition to net zero will require significant financing.” Currently annual global climate finance flows represent “only about 30% of the US$2.5 trillion needed each year until 2030 to meet the Paris Agreement Goals.”

“Carbon credits offer a market-driven solution to bridge the financing gap and enable decarbonisation that would otherwise not have occurred.”

He concluded that: “Australia is well-placed to partner Singapore in promoting robust global carbon markets. In particular, Singapore looks forward to Australia joining the Coalition to Grow Carbon Markets.”

CMI interim CEO and Director of Corporate Transition Kurt Winter highlighted the 10-year anniversary of the Australia’s Comprehensive Strategic Partnership with Singapore in his opening speech.

“A new version of the partnership agreement [was signed] last Wednesday, by Singapore’s Prime Minister Lawrence Wong, and Australia’s Prime Minister Anthony Albanese”…with “a strong focus on the need to cooperate on climate change.”

“Because all Asia Pacific nations are acutely aware that strategic cooperation on multiple fronts, especially in finance and trade, is crucial in order to successfully fight climate change.

“We can all see the positive transformative opportunities for our region that will be realised through “immediate steps” to avert a climate crisis – economic prosperity in the burgeoning of new industries, restorations of vital ecosystems and community empowerment and resilience.”

Winter underscored the importance of governments strengthening carbon markets, building confidence in them, “recognising that this is an essential task in order to grow them.”

He called on governments across the region, including Australia, to “back-in the maturing and converging body of best practice voluntary standards.”

He also called for “a clear program on carbon market cooperation across the region [that] will be essential to building strong and interconnected carbon markets.”

In the first plenary of the opening day panelists reflected on the theme of Asia-Pacific carbon markets on the rise. The discussion focused on the evolving carbon market in Asia, highlighting four key market segments: compliance market in China and Australia, buyer countries like Japan and Singapore, supply side markets in ASEAN, and voluntary markets.

Bryan McCann, Head of Asia-Pacific, Abatable, in referencing the developments in Asia Pacific, said: “So here it is very much carbon markets, not carbon market.”

In commenting on the state of harmonisation, James Shaw, Former New Zealand Climate Minister and Member of Parliament; Operating Partner, Morrison Global, predicted that there would be a “divergence in the near term and then followed by convergence in the long terms.”

“It becomes easier when you’ve got that king of leading group of compliance markets.”

“If you can see countries like Singapore who have worked out how to turn a liability into an asset in a kind of economic sense, then you are more likely see other countries adopt it.”

Charis Yeap Khai Leang, SE Asia Regional Lead, Green Finance and Carbon Pricing Mechanisms, British High Commission Singapore, reflected on the fragmentation of the carbon markets, and the opportunities for harmonisation across countries and markets. She also touched on the role of regulators in the voluntary carbon market and of mandatory compliance to push the demand side, as well as the operationalisation of Article 6 in the region, and the importance of private sector engagement for capital flow and growth of the sector.

On the issue of integrity, she asked “what is great and what is good enough?” She pointed out that companies were looking for “air cover” as a means to give assurance to the demand side that there are principles setting out what is “good enough” for them to participate in the market. She highlighted the UK government principles for voluntary carbon and nature market integrity as an example of what other governments could do to support demand side confidence and participation.

The Carbon Market & Investor Forum is held in Singapore from 16-17 October 2025. With carbon markets on the rise across the region, the Forum will explore market dynamics and future outlooks, the role of removals, reductions and avoidance, and the implications of international pricing mechanisms such as CBAM, Article 6, and CORSIA. Sessions will also spotlight technological innovation driving market progress, the growing importance of nature-based solutions, and how to turn climate ambition into investable action.

Link to Ambassador Ravi Menon’s speech.

Link to Kurt Winter’s speech.