CMI’s annual business sentiment survey

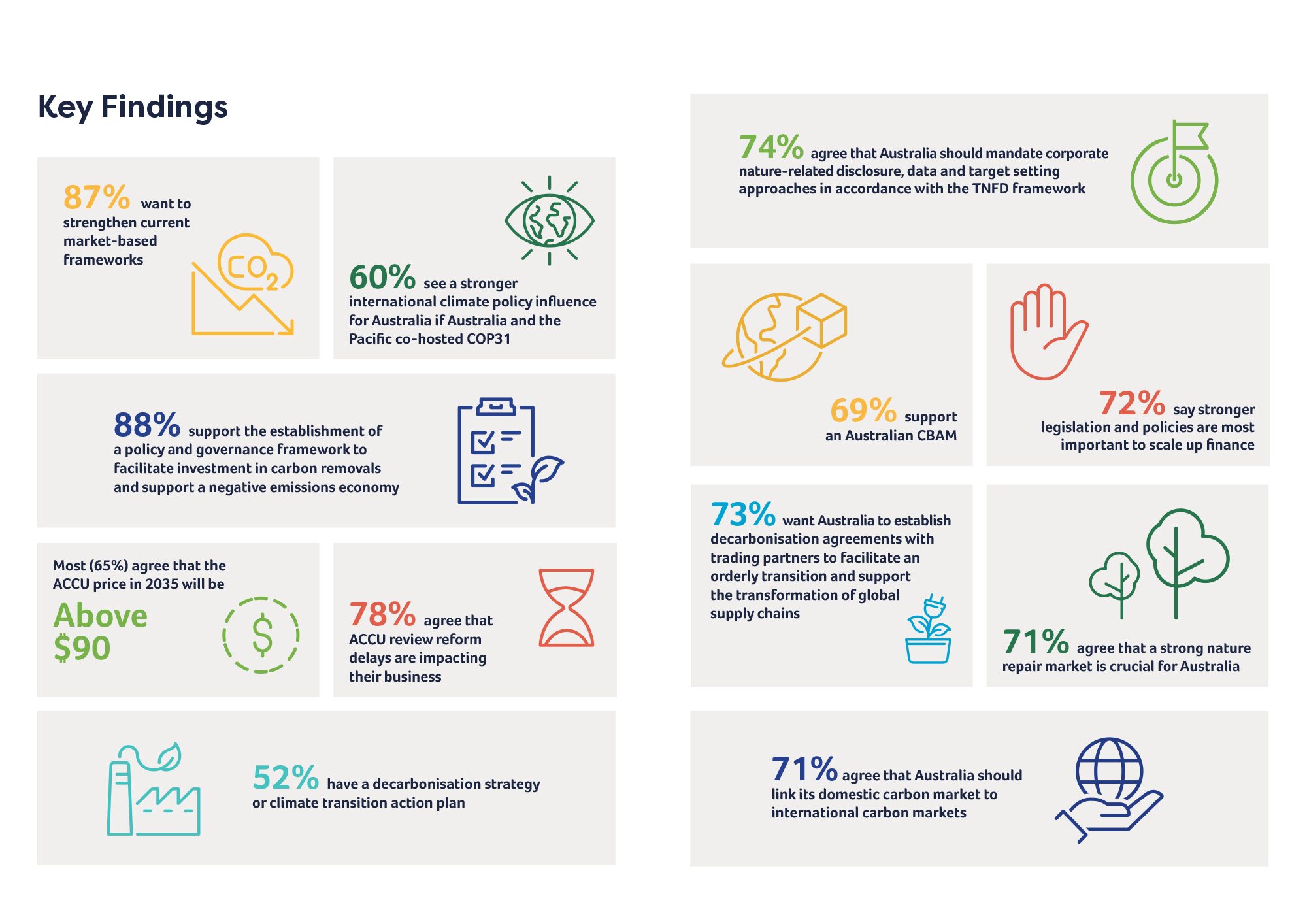

The CMI Australian Business Climate Survey surveys attitudes of Australian business and industry annually to gauge views on international and domestic policy, carbon markets and pricing, and corporate climate risk, disclosure and strategy.

Now in its 11th year, the Australian Business Climate Survey provides the latest insights into Australian business leaders’ views towards Australia’s evolving climate policy, as well as shining a light on the actions of the business community in leading the transition to net zero and beyond.