The Oxford Principles for Net Zero Aligned Carbon Offsetting(the Oxford Principles) provide guidance for corporates, governments and cities in designing and delivering their net zero commitments. The Oxford Principles highlight the role for carbon offsets in addition to deep at-source emissions reduction cuts, and guide their use as a complementary tool for hard-to-abate sectors where direct decarbonisation is not yet possible.

The original Oxford Principles were established around four key characteristics to guide carbon market engagement:

- Prioritise emissions cuts, apply due diligence to ensure the environmental integrity of credits where they are used, and regularly revise carbon market engagement strategy to ensure its alignment with best practice.

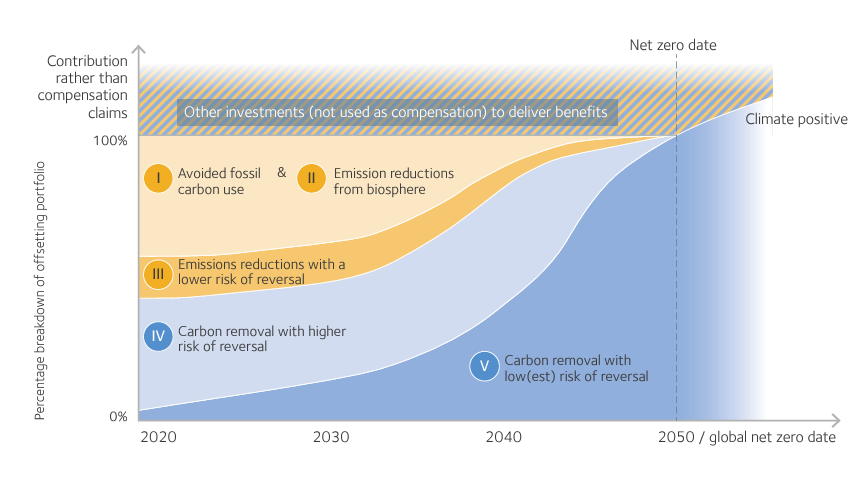

- Focus carbon market investment on removals-based projects, only using removals-based credits for residual emissions by 2050.

- In addition to the above, transition investment to removals with robust storage (low risk of reversal) to compensate for residual emissions by 2050.

- Supporting ongoing research & development on integrated approaches to achieve net zero.[1]

To further support credible engagement with carbon markets and avoid greenwashing risks, a revised version of the Principles (Revised Principles) was released in February 2024. The Revised Principles call for “a major course-correction in carbon markets and offsetting practices,” as well as to further clarify the role of carbon credits in net zero aligned climate plans.

The Revised Principles (2024) build on the four characteristics of the first iteration, to provide further clarity and detail around six key areas:

- The urgency of reducing emissions.

- The need to close the carbon removal gap, by increasing removals over time.

- The critical role of nature-based solutions in addressing drivers and impacts of climate change.

- Importance of distinguishing between risk of reversal and co-benefits of different carbon removal and storage methodologies. Some of these distinctions are outlined in the chart below

- Reflection of new international guidance on net zero and nature commitments, particularly through the inclusion of biodiversity and ecosystem restoration targets.

- Recognition of the importance of mitigation efforts beyond an organisation’s value chain, where financially possible.[2]

Access the Revised Principles(2024) here.

Image: Shifting offset investments towards low-reversal risk removals by 2050, the Oxford Principles for Net Zero Aligned Carbon Offsetting (Revised 2024) p. 19.

[1] The Oxford Principles for Net Zero Aligned Carbon Offsetting, September 2020.

[2] Oxford Principles for Net Zero Aligned Carbon Offsetting (revised 2024), February 2024.