World heads of state have now left Sharm el-Sheikh, and it’s down to business as underlying technical negotiations have left a lot of work and political tensions to resolve in the final week – for the Egyptian Presidency as well as ministerial level heads of delegations.

There’s considerable uncertainty about whether the political will exists to resolve these and outcomes from the G20, including how any thawing of US-China relations, and US mid-term elections will influence ambition on the ground, according to CMI CEO John Connor from Egypt.

“Progress in week one has been slow, not unsurprisingly, and political leaders and the Egyptian Presidency have a lot of ground to make up on key issues including climate finance, carbon markets and next year’s global stocktake,” said Connor.

Key issues to be addressed in specific workstreams or a “cover” summary text from COP27, include:

- adequacy of climate finance for developing countries including establishing a loss and damage facility

- rules for international cooperation and transparency in carbon markets

- details for the first global stock take in 2023 (a five yearly review of collective effort a key part of the Paris Agreement “ratchet mechanism”, preceding by 2 years five yearly national effort updates)

- details on agriculture/food security and mitigation work programs

- guidance on how climate change and nature can be addressed together, and links to global biodiversity talks or the framework under Convention on Biodiversity at CBD COP 15 next month

“The challenge will be to build on the momentum from COP26 and in the negotiations last week to create a pathway for accelerated investments in decarbonisation and support for impacted communities.”

“In the halls around the formal negotiations there has been an important focus on corporate accountability around net zero emission claims and we expect more on the evolving ecosystem of integrity and transparency for international voluntary carbon markets this week.”

“The interaction of these voluntary integrity initiatives with the emerging reforms to Australia’s compliance Safeguard Mechanism and our carbon crediting framework will be crucial in mobilising investments that can accelerate Australia’s emission reductions to meet and beat the 43% target by 2030, and the greater ambition needed in 2035 targets to be determined by 2025,” said Connor.

Week One Wrap:

Article 6 text progresses, but final version unlikely to be delivered in Sharm el-Sheikh

The Subsidiary Body for Scientific and Technological Advice (SBSTA) convened again with the looming task of fulfilling the Glasgow Mandate to finalise the text on Article 6 of the Paris Agreement by the close of this COP.

Article 6.2 on cooperative approaches took a substantial amount of the SBSTA’s time on Thursday, highlighting the importance placed on establishing a clear, equitable and high-integrity program from the outset for the international carbon market space.

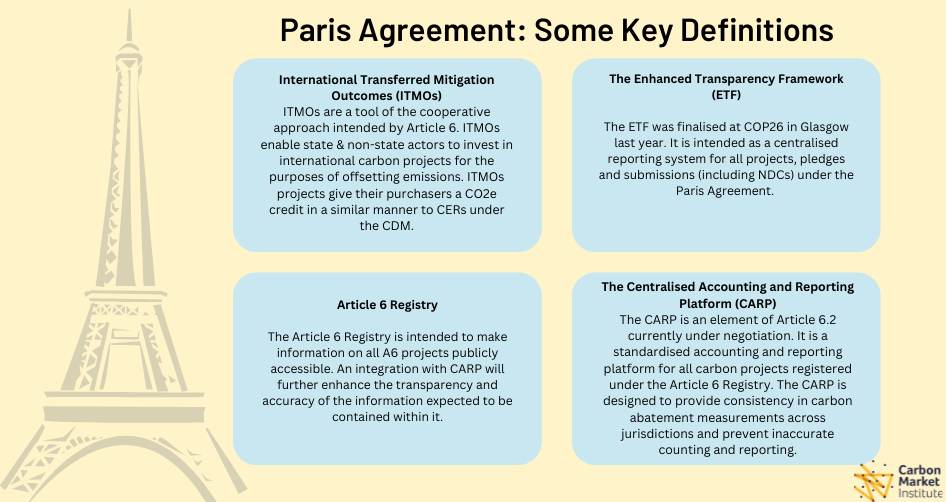

Appropriate engagement with Internationally Transferred Mitigation Outcomes (ITMOs) via the Article 6.2 mechanism was also in contention. Some negotiating groups pushed for the removal of guiding principles and an exclusion of virtual participation in reporting processes (hindering the opportunities for some representatives to engage), while others highlighted the need for strong guiding principles as an assurance of high-integrity and transparent projects under the mechanism.

Additionally, disagreements have persisted on the most appropriate manner for reporting projects and their associated reductions, with the Article 13 Enhanced Transparency Framework (ETF) likely to be relevant as negotiators discuss the merits and challenges of integrating the ETF with the proposed Centralised Accounting and Reporting Platform (CARP) and Article 6 Registry.

The integration of the Article 6 Project Registry with the CARP will continue to be assessed through the initial implementation period of this article, as a conclusive decision on the interlinkages between these mechanisms could not be made.

Recognising the importance of establishing this database as a transparent and accurate source of information for market investors and proponents, CMI supports the integration of these two frameworks as a means of ensuring that these global carbon market exchanges are fit for purpose.

Regarding Article 6.4, a rough draft was circulated on Thursday morning, with negotiations continuing into the night. There continued to be questions regarding the transfer of Clean Development Mechanism (CDM) projects from under the Kyoto Protocol to Article 6.4, with a particular focus on how to transfer carbon accounting methods from the CDM to A6, without double counting reductions.

In spite of the Glasgow Mandate to produce a clear text by the conclusion of COP27, this seems unlikely with multiple negotiating groups still contending with each other. Meetings have concluded with a call to leave draft texts with the Secretariat of the SBSTA, and subsequently the COP Presidency.

Adaptation, Loss & Damage funding remain on the table and may be influenced by Article 6 outcomes

Separate sessions on adaptation funding and the establishment of a facility and funding for loss & damage have progressed slowly. Outcomes from Article 6 negotiations, including climate finance flows from carbon market rules, may influence progress in those negotiations.

The Subsidiary Body on Implementation (SBI) held a session on its draft text for the Fourth Review of the Adaptation Fund. Developing countries used the session to highlight the perceived issues of accountability for pledges made by developed countries, remaining in the fulfilment of the fund.

Similarly, the session on Funding Arrangements Responding to Loss & Damage saw further focus on the gap between needs and fulfilment of this funding. Opinions on the most appropriate mechanisms of finance delivery continue to differ, however it can be agreed that greater action is required by both state and non-state actors.

Australian Announcements

Australia has made a number of announcements so far at COP27, reflecting its increased presence at this year’s meeting:

Joint media release: Australia joins International Mangrove Alliance for Climate

Teaming up with Google to tackle climate change in the Indo-Pacific region

New Ambassador for Climate Change

Australia joins forests partnership to drive climate action

Australia rises to Green Shipping Challenge at COP27

Note for editors

CMI is represented at COP27 by Janet Hallows, Director Climate Programs and nature-based solutions and John Connor, CMI CEO, who was the head of the Fijian Government’s COP23 Presidency Secretariat.

CMI has formal business organisation observer status with the UNFCCC and will be hosting and, with its members, participating in numerous panel sessions in the Australian Pavilion and other venues at COP27.

For regular updates on COP27 and CMI’s events and updates, visit our Cop27 Hub here.

About the Carbon Market Institute

The Carbon Market Institute (CMI) is a member-based institute accelerating the transition towards a negative emissions, nature positive world. It champions best practice in carbon markets and climate policy, and its nearly 150 members include primary producers, carbon project developers, Indigenous organisations, legal, technology and advisory services, insurers, banks, investors, corporate entities and emission intensive industries. The positions put forward constitute CMI’s independent view and do not purport to represent any CMI individual, member company, or industry sector. CMI’s latest Advocacy Policy Positions Statement can be viewed here.

For further information, contact Thomas Hann on 0408880536 or thomas.hann@carbonmarketinstitute.org