Introduction to carbon markets

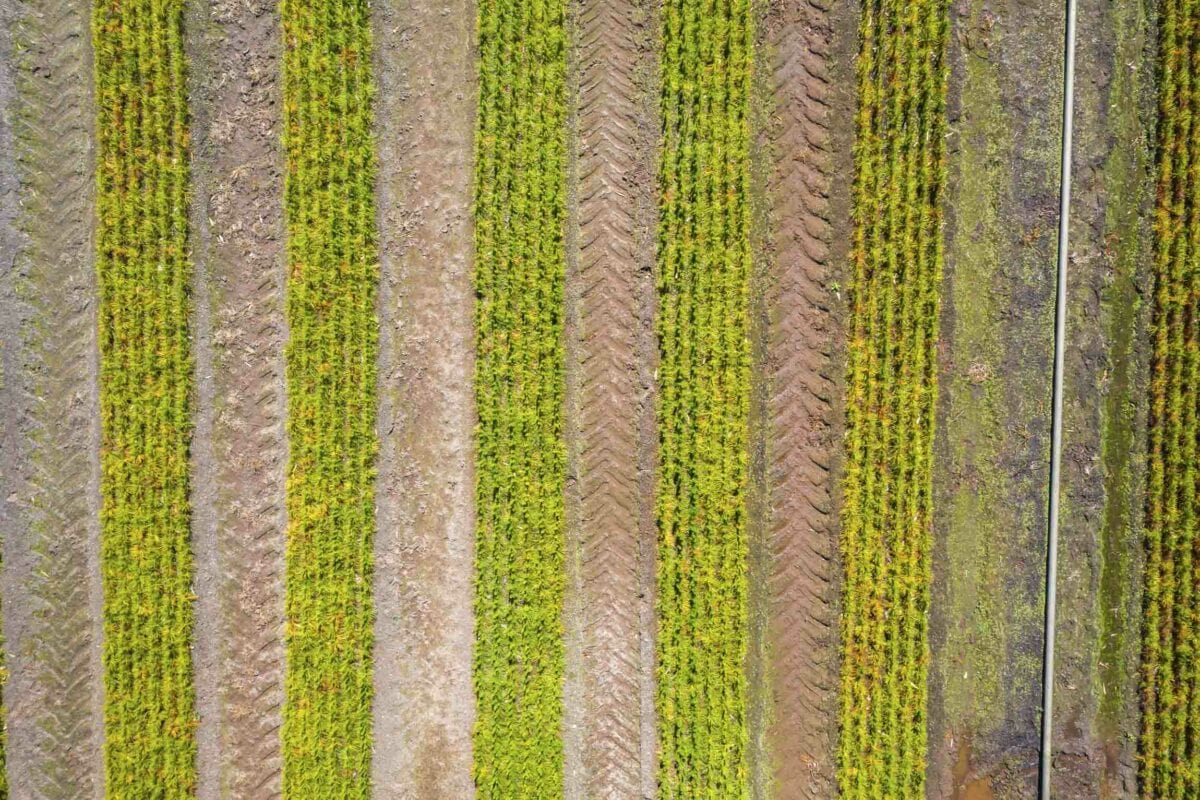

Carbon markets are a mechanism that puts an explicit price or value on carbon emission reductions, or carbon removals from the atmosphere. If designed well, carbon markets can: Incentivise demand for emissions reduction, drive decarbonisation at lowest cost, attract large amounts of private sector capital to emissions reduction and ultimately scale up high integrity climate solutions that will address climate change faster.

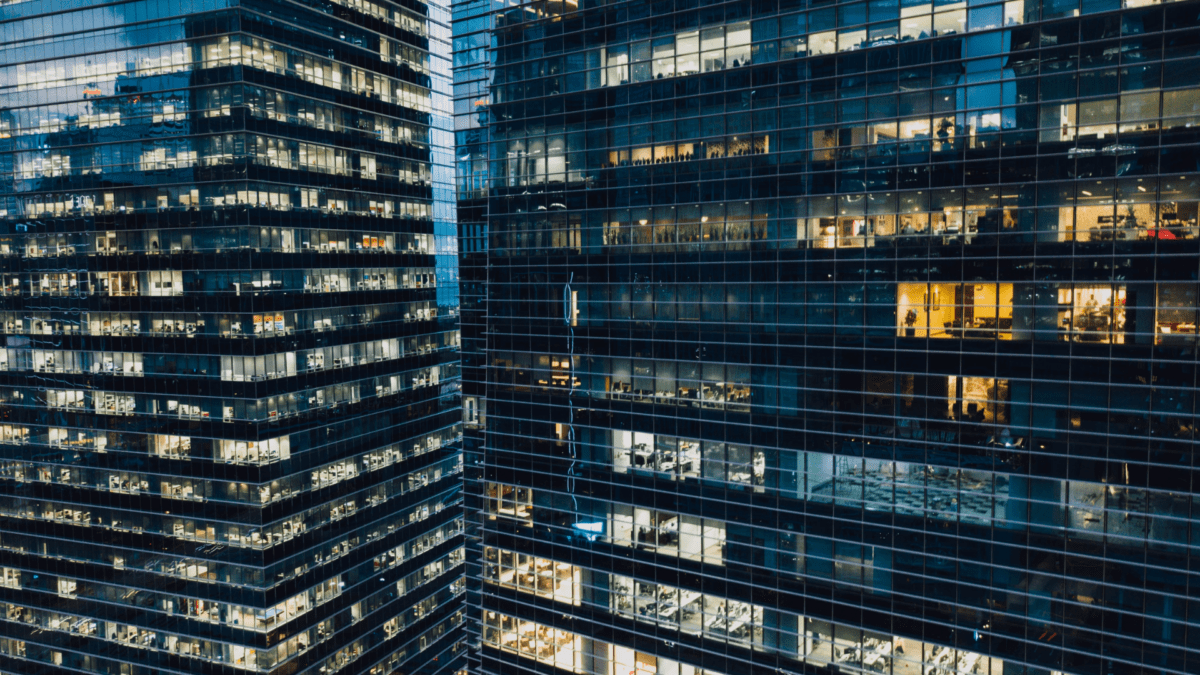

As governments and business transition to net zero or negative emissions, there will be circumstances where it’s not possible or not economic to directly reduce on-site carbon emissions to meet short and medium-term objectives. In these circumstances, or when businesses want to go beyond their targets, they can buy carbon credits that represent avoided emissions or emissions reductions – as long as the credits aren’t purchased in order to delay feasible in-house decarbonisation.

Just like a stock market allows the trading of shares, the carbon market provides the means to trade these emission reductions in domestic and global markets. This trading can be compliance-driven (done in order to meet legislated requirements) or voluntary (done to meet voluntary goals).